Interim Business Process

Closing TANF Cases for DCSE Non-cooperation When Good Cause Does Not Exist, Paternity Has Not Been Established and Six Months of TANF Benefits Have Been Received

Current Functionality

A defect has been identified in VaCMS regarding closure of TANF cases when 1) DCSE non-cooperation without good cause has occurred, 2) paternity has not been established and 3) six months of TANF payments have been received. The current functionality in VaCMS incorrectly starts the six-month count for receipt of TANF payments with the non-cooperation begin date entered in VaCMS. The six-month count should begin with the first month of entitlement or in the case of a child added after the TANF case has been approved, the first month assistance is received for the child (TANF guidance at 201.10.C.3). Consequently, TANF cases are not closing timely.

Interim Business Process

The worker must place the case in the Case Change/Closure mode and complete the following steps:

1. From the left navigation, select Program Request and click on the pencil next to the SNAP Program. On the SNAP Program Request – Details screen, check the Do not evaluate for SNAP Transitional Benefits box. The household is not entitled to SNAP Transitional Benefits per SNAP policy at Part 12.H.1. The TANF income will continue to count toward the SNAP case for six months as a penalty for non-compliance with another program's requirements (Part 12.D).

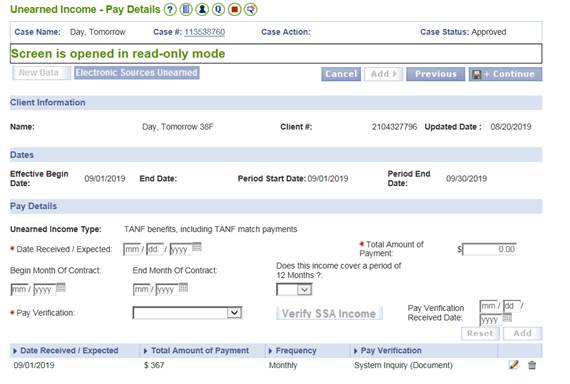

2. From the left navigation, select Income and then Unearned Income. Enter the TANF payment information on the Unearned Income – Details screen, save and continue to the Unearned Income – Pay Details screen.

On the Unearned Income – Pay Details screen, enter the TANF payment amount, select Add and then save and continue.

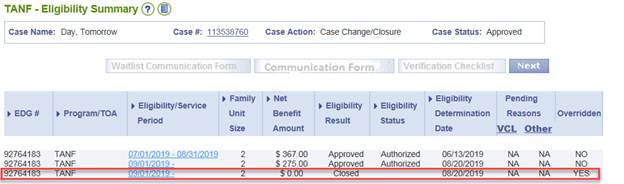

3. Run Eligibility and select the Override Summary tab.

4. Complete the Override Detail screen. Select the TANF EDG, enter the required information and select Approve. The Override Summary screen will display.

5. Run Eligibility and review results. TANF case should be closed.

6. The SNAP TOA should remain SNAP and not change to Transitional SNAP.

7. TANF income should continue to be counted.

8. From the left navigation, create a manual task/reminder to remove the TANF penalty income. Set the task/reminder for the first business day in the last month of the six-month penalty period. In this case, the penalty period is September 2019 through February 2020. The task/reminder should be set for February 3, 2020.

9. Thoroughly document actions taken in the VaCMS case narrative or page level comment screen.

Interim Business Process Expected End Date

TBD

Updated: 08/31/19