|

Interim Business Process Temporary 2020 Census Income |

Current Functionality

For TANF, SNAP and Medical Assistance applications and ongoing cases, an issue has been identified in the VaCMS with entering temporary 2020 census income received directly from the U.S. Census Bureau. Though the income is earned, currently, the income must be entered into the VaCMS as unearned.

Interim Business Process for entering temporary 2020 Census Income

Before entering income received from temporary employment with the 2020 U.S. Census into the VaCMS, workers must determine whether the income is countable or not countable.

ü Income received from temporary employment for the 2020 U.S. Census

o If the income is paid directly by the U.S. Census Bureau:

§ TANF – The income is not countable.

§ SNAP – The income is not countable.

§ Medical Assistance – The income is:

· Not countable for ABD and Non MAGI F&C covered groups.

· Countable for MAGI and LTC 300% covered groups.

· Countable for Patient Pay determination, regardless of covered group.

o If the income is paid by a temporary employment agency or third party entity:

§ TANF – The income is countable.

§ SNAP – The income is countable.

§ Medical Assistance – The income is countable.

ü The worker must enter income paid directly by the U.S. Census Bureau into the VaCMS as Unearned Income.

ü The worker must enter income paid by a temporary employment agency or third party entity into the VaCMS as Earned Income.

Entering Income Paid Directly by the U.S. Census Bureau

To exclude income paid directly by the U.S. Census Bureau, the worker must enter the income into the VaCMS as the Unearned Income Type – Census Income.

NOTE: The worker must document the case to indicate that even though the income is considered earned income, the income is entered as unearned income as part of this interim process.

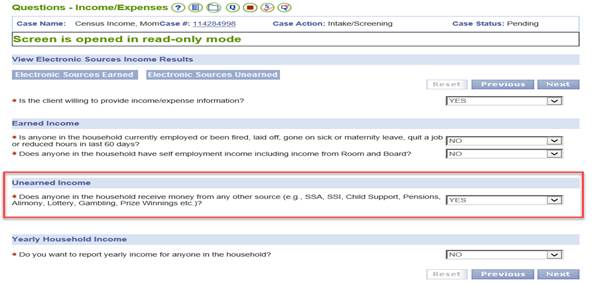

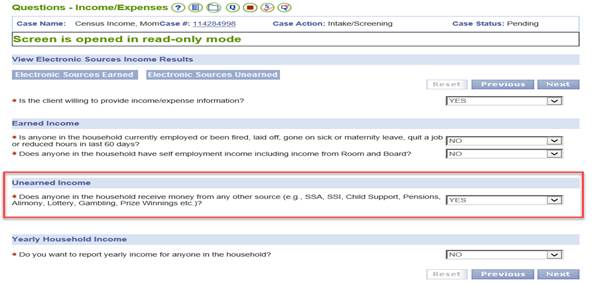

1. On the Questions – Income/Expenses screen, select Yes for the question, Does anyone in the household receive money from any other source?

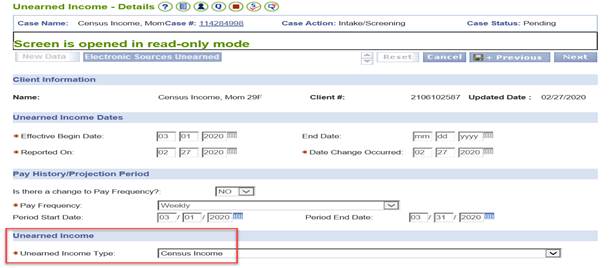

2. On the Unearned Income – Details screen, enter the Effective Begin Date, Pay Frequency and select Census Income as the Unearned Income Type.

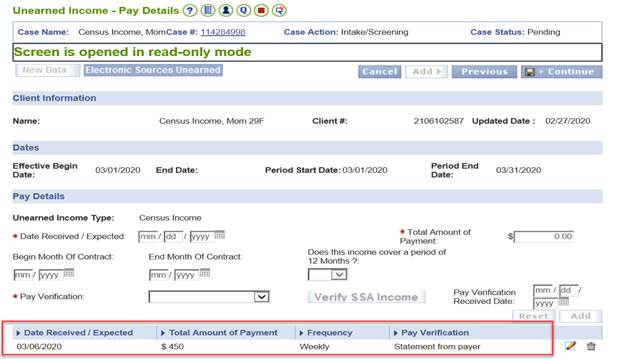

3. On the Unearned Income - Pay Details screen, enter the pay details. In the below test case, the applicant is expected to work 30 hours per week earning $15 per hour. Her first weekly check is expected March 6, 2020.

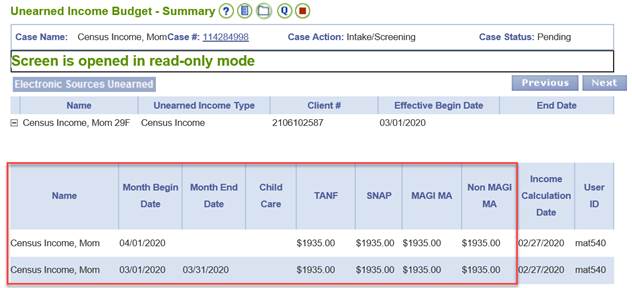

4. To ensure the income is correctly converted, review the Unearned Income Budget – Summary screen.

5. Review the Eligibility Summary and Client Income Details screens.

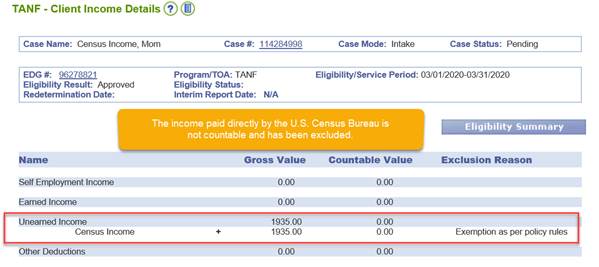

The TANF – Eligibility Summary screen shows an Approved Eligibility Result.

The TANF – Client Income Details screen shows that the VaCMS correctly excluded the income.

The SNAP – Eligibility Summary screen shows an Approved Eligibility Result.

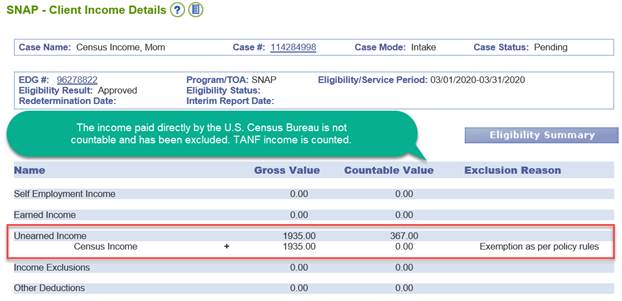

The SNAP – Client Income Details screen shows that the VaCMS correctly excluded the Census income and counted the TANF income.

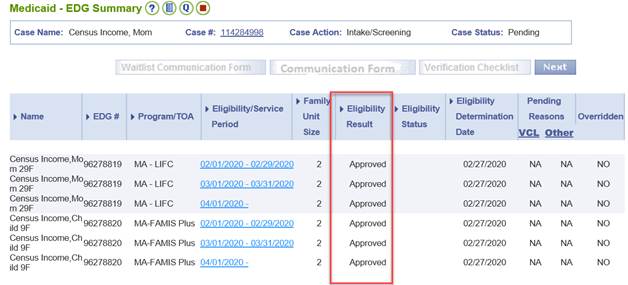

The Medicaid – Eligibility Summary screen shows an Approved Eligibility Result.

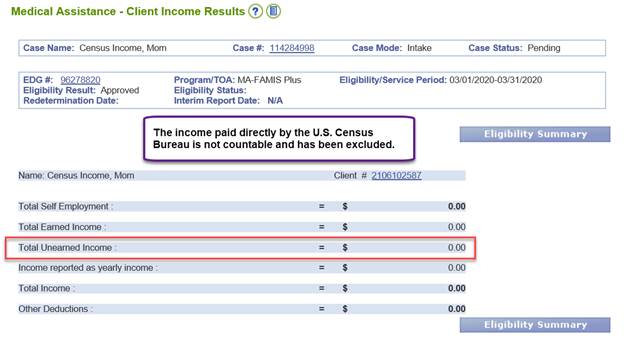

The Medicaid – Client Income Details screen show that the VaCMS excluded the income.

NOTE:

If the eligibility result for an individual is a covered group where the census income should count, the worker should evaluate the income manually outside of VaCMS and document in the case narrative to show the manual calculation. All disregards that are applicable to the covered group should be used.

If the manual evaluation results in a change of eligibility, use the override function to enroll the individual in the correct AC, or to deny/close coverage and document the case to show the reason for the override.

The worker may also need to use the Spenddown and/or Patient Pay adjustments – if either adjustment is used, the worker must document the case to show the reason for using the adjustment.

Entering Income Paid by a Temporary Employment Agency or Third Party Entity

Income paid by a temporary employment agency or third party entity is countable earned income. The worker must enter the income into the VaCMS by appropriately answering questions in the Earned Income section on the Questions – Income/Expenses screen and completing the Employment – Employer and Pay Details screens.

Entering ESP Activity Details for VIEW Participants

Income received from temporary employment agencies or third party entities must be entered as the Core activity Employment.

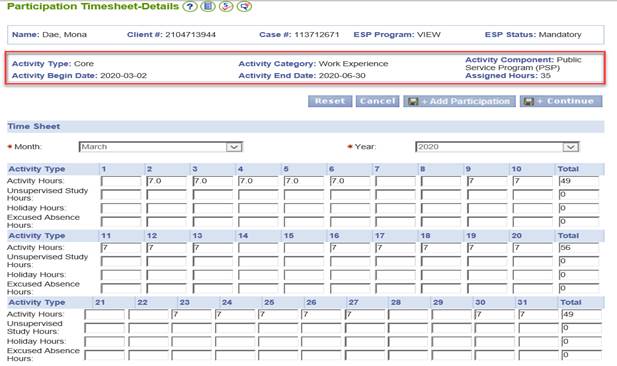

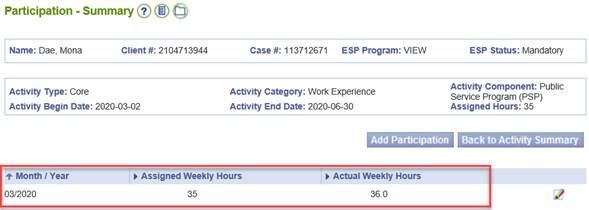

Since income received directly from the U.S. Census Bureau is entered into the VaCMS as unearned income, to ensure the federal work participation rate is not adversely impacted, workers must enter the employment as the Core activity Public Service Program (PSP) and complete the Participation Timesheet.

Activity Type: Core

Activity Category: Work Experience

Activity Component: Public Service Program (PSP)

Component Description: Community Service Program