|

Medical Assistance |

Income Verifications and the Hub - MA |

About

The VaCMS has the ability to check customer reported income against IRS information contained within the Federal Hub for tax payers. This guide explains how this feature works in the VaCMS during the Intake or MA Renewal driver flows.

Note: There are special considerations in the VaCMS income verifications for joint filers. If the case you are working includes joint filers, please review the procedure help for the topic on “Record Tax Return Information.”

Note: The Federal Hub can be used to verify income for the Medicaid program only. You must obtain valid income verifications from a source other than the Hub for SNAP, TANF, Child Care and Energy Assistance.

How Does Income Verification Work Using the Hub?

Most verifications are manually initiated in the VaCMS; SSN, Citizenship, and Alien Status are all examples of verifications you must initiate manually by clicking the Verify buttons throughout the VaCMS.

Income verification, however, is different. Income verification happens automatically when you run eligibility at the end of the Intake or MA Renewal driver flow (It is important to note that the VaCMS does not call the Federal hub when running eligibility following any other case actions -- for example, case changes). The automated process for income verification is as follows.

The diagram below provides an overview of the process. First, the VaCMS checks to see if the income claimed by the customer is at or below the Federal Poverty Level (FPL) limit. If it is, the VaCMS checks to see if the claimed income matches the income claimed by the customer in their last year tax filings by matching it against the IRS database by way of the Federal Hub.

If a match is found in the IRS database and a reasonable compatibility test shows that the match is within 10% of the amount reported by the customer, you do not need to perform any additional income verification because eligibility results will show as approved for income verification..

If the found match is not within 10% of the amount reported by the customer, or the IRS data is not found, the eligibility results will show as “Pending”.

If the results show as “Pending”, you will need to perform pay verifications (for instance, review pay stubs) before eligibility determination can be completed. If the results show as “Approved”, you can authorize the results.

Note: During the Intake process, if a customer fails to supply verifications within 45 days, you must deny or close the appropriate program(s) on the case depending on whether eligibility results have been authorized or not.

During the MA Renewal process, if a customer fails to supply verifications by their renewal due date, then you must close the MA program on the case. If the customer then submits verifications within the 90-day grace period, then the MA program may be reinstated.

See the Quick Reference Guide titled, “Denying Applications, Denying Programs and Closing Programs in the VaCMS” for additional instruction.

Example

A customer indicates that he is a taxpayer and that he makes $600 / mo. He is not a joint filer. When you run eligibility, the VaCMS first checks that his income is at or below the FPL limit based on the composition of his household.

If the claimed income is found to be above the Federal Poverty Level (FPL) limit, then the system does not attempt to verify his income through the Hub. His eligibility determination will be denied.

If, on the other hand, the system confirms that his income falls within the limit, the VaCMS will run a check to verify that the $600 per month income being claimed matches his IRS data for the previous year.

If the system finds a match, the system will confirm whether or not his reported income falls within the 10% over / under reasonable compatibility range (which, in this case, is $540 - $660) of the matching record in the IRS database. If it is found that the reported income does fall within this range, his eligibility will be approved and no additional income verifications will be required for him.

How Do I Know Whether Income Verification Was Run?

|

The following table lists the different IRS income verification messages that may appear on the Certification page in the VaCMS, when they appear, and the actions you should take when you receive them. |

|

IRS Income Verification Message* |

When Does the VaCMS Display this Message? |

What Action Should Workers Take? |

|

Reasonable Compatibility is not performed. |

· When sufficient information from the IRS hub is not available. |

|

|

IRS data is not available. Yearly Income is used. |

· When the IRS hub is down and no response is received. |

|

|

IRS data is not available. Verify Income using other acceptable sources. |

· When the IRS hub is down and no response is received. |

|

|

Reported Income is not within the reasonable compatibility. Verify Income using other acceptable sources. |

· When the VaCMS receives data from the hub, but the customer reported income is not within the 10% over / under reasonable compatibility limit. |

Note: It is possible for some customers to be approved even if the income they reported does not fall within 10% of the income reported in the IRS database. Specifically, if the income reported by the customer and the IRS database are both under the FPL. If a customer is not approved:

|

|

IRS Information is not required for income verification for the non-filer household. Verify Income using other acceptable sources. |

· When customers requesting MA on the case are non-filers. |

|

|

Reported income is within the reasonable compatibility. |

· When IRS data is received and the reasonable compatibility test passes. |

|

|

Customer has not provided authorization to use IRS data. Verify income using other acceptable sources. |

· When “Do Not Use” is entered for “Has the Client Authorized income use” during the renewal process, left blank, or authorization has expired. |

|

Note: If the customer is a tax filer, you should run eligibility even if you do not have a specific income verification to see if the reported income is within the reasonable compatibility standard

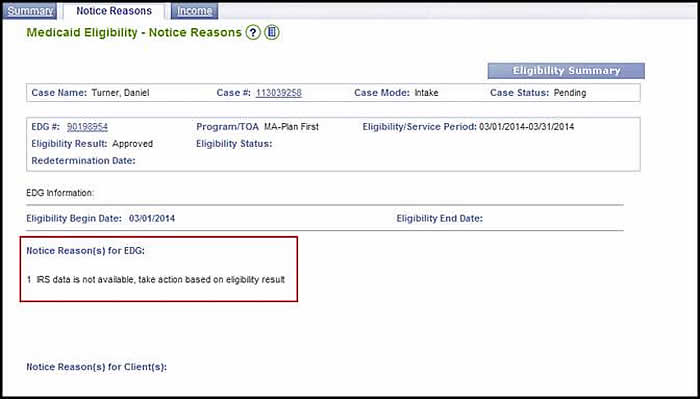

*The messages described here appear on the Eligibility Summary page and also appear on the Notice Reasons tab of the Eligibility Summary page after clicking on an eligibility result as shown in the image below.

Updated 10/03/2016